If you’ve been labeled as a high-risk driver, finding good car insurance might seem tough. But don’t worry, you still have options. Certain insurance companies understand your situation and offer plans that won’t break the bank.

For instance, well-known insurers like Dairyland, National General, Progressive, and The General have plans that are kinder to the wallets of high-risk drivers. Especially, Dairyland and National General get high marks for making their customers happy and providing full protection.

Now, when you’re looking around for the right plan, it’s key to think about a few personal details. Your driving record, how old you are, and even your credit history can influence the price and kind of coverage you can get.

By taking the time to really figure out what you need and comparing what’s out there, you can land a car insurance plan that not only fits your life but also gives you peace of mind. Remember, even as a high-risk driver, you deserve a policy that protects you well and is also fair in price.

Key Takeaways

- Good insurance companies understand the specific needs of high-risk drivers and offer tailored insurance options to meet their unique needs.

- Positive customer reviews indicate good service and support from the insurer, which is important for high-risk drivers.

- The stability of the insurance company is crucial to ensure they will be there when needed, especially during a claim.

- There are several top-rated insurance options for high-risk drivers, including Dairyland, National General, Progressive, Bristol West, and The General .

Evaluating Top-Rated Insurance Companies

Are you a high-risk driver looking for car insurance? Finding the right insurance can be tricky, but we’re here to help you understand what to look for and how to choose the best policy for you.

First off, why is it important to find a good insurance company? Well, if you’re a high-risk driver, you’ve probably faced some challenges getting insurance. Maybe you’ve had accidents or tickets in the past. Insurance companies use this info to figure out how likely you’re to have an accident and file a claim. They often charge high-risk drivers more for insurance because they expect these drivers to cost them more in the long run.

Now, how do you find a great car insurance company that won’t break the bank? Start by looking for insurers that have experience helping high-risk drivers like you. They should understand your specific needs and offer policies that are a good fit.

It’s also smart to look at what other customers say about these insurers. Happy customers usually mean the company is doing something right. Are people saying the insurer helped them when they needed it and offered good service? That’s a green flag!

Don’t forget to check how stable the insurance company is. A stable company is more likely to be there for you when you need them, like if you have to make a claim after an accident.

When you’re comparing different car insurance options, put them side by side. Look at what each policy offers and how much it costs. Remember, the cheapest option isn’t always the best. You want insurance that gives you a good mix of coverage, service, and value.

In short, if you’re a high-risk driver, you need car insurance that fits your situation, doesn’t cost too much, and comes from a company that will support you when you need it. Take your time, do your homework, and you’ll be able to make a confident choice. Safe driving!

Best Insurance for At-Risk Drivers

Are you a driver who’s often considered high-risk? It can be tough to find good car insurance that fits your needs. But, don’t worry, there are insurance companies out there that create plans just for drivers like you. These companies understand the challenges you might face, like having a few more marks on your driving record or a lower credit score, and they’re ready to help.

Let’s dive into what makes a company great for high-risk drivers like you. They offer coverage that can protect you even if you’ve had accidents or speeding tickets. They also help people who may not have the best credit history or are new to driving. And if you’ve had trouble with insurance in the past, say from not having coverage for a while, these companies are more understanding.

Here’s a list of some of the top car insurance options that cater to high-risk drivers, with a focus on the benefits they offer.

National General Insurance could be a great choice if you’re watching your budget. They offer some of the most affordable plans. While the average cost in Washington might be around $1,122 per year, it’s always good to get a quote to see what it would be for you.

Dairyland is another solid option. They’re known for being friendly and helpful, making them a good choice if you want a company that will work with you.

Progressive Insurance is a go-to if you’ve had a DUI. They’ve plans designed to help drivers who’ve faced this challenge.

For the younger drivers who might be seen as high-risk, The General has special coverage that could be a good fit.

Each of these companies offers different rates and coverage options, so it’s important to find the one that’s just right for you. But one thing’s for sure, being a high-risk driver doesn’t mean you can’t get great car insurance. There’s a plan out there with your name on it, ready to give you the protection and peace of mind you deserve.

High-Risk Auto Insurance Coverage Comparison

If you’re a High-Risk Driver, finding the right Car Insurance can seem daunting. But don’t worry, we’re here to help you step by step. It’s like putting together a puzzle; each piece is a factor that affects your insurance, like your driving history or credit score. By looking at each piece, we can see the whole picture and find the best insurance for you.

Let’s say you’ve had a tough time on the road, like a DUI, or you’re a new driver, or maybe your credit isn’t great. All of these can make insurance companies see you as a higher risk. But some insurance companies might offer better deals for you than others.

For example, if you’re in Washington and have a DUI, you might find that Esurance Auto Insurance has the lowest prices. If you’re a young driver, The General might be your best bet for affordable rates. Farmers Insurance is also a great option; they’re known for good prices for High-Risk Drivers, with an average cost that’s easy on the wallet. National General is another good choice, scoring high for customer satisfaction. And if you’re eligible, Dairyland Insurance gives you quality coverage without breaking the bank.

It’s not just about finding the cheapest option, though. It’s about finding the Car Insurance that fits your life. You want a company that understands your needs and has your back. So, take a good look at the average prices, but also think about what you need from your insurance and how well the company serves its customers in your state.

Affordable High-Risk Auto Insurance Options

If you’re a high-risk driver, finding car insurance that’s both affordable and offers good coverage might seem tough, but it’s definitely possible. When you’re looking for insurance that doesn’t break the bank, it’s a smart move to look around and get quotes from different companies.

Some insurance providers are known for being more welcoming to high-risk drivers, and they may have better prices for you. For instance, in Washington, companies like Dairyland, National General, Progressive, and Bristol West are known for giving high-risk drivers good deals.

When you’re checking out your options, make sure to look at how happy other customers are with these companies, if they’ve many complaints, and if they’ve insurance options specifically for high-risk drivers. Some insurers, called nonstandard companies, are all about helping drivers like you. They often have rates that are made just for your situation.

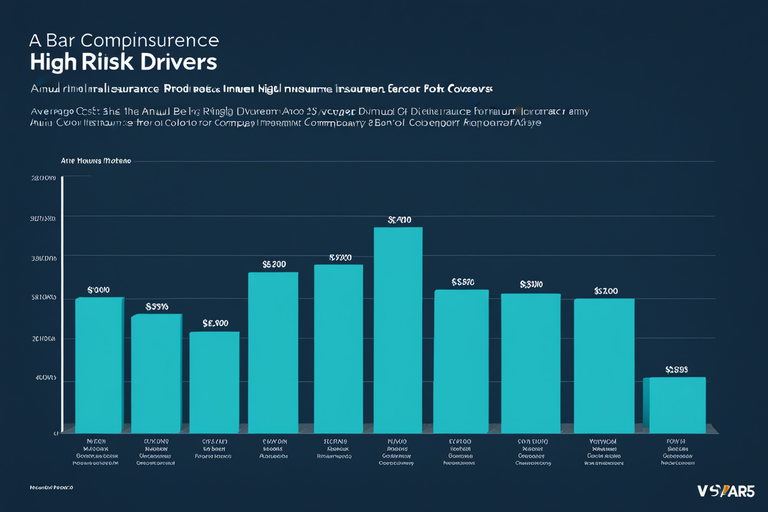

High-Risk Driver Insurance Cost Analysis

If you’re a high-risk driver looking for car insurance in Washington, you might be wondering about costs. Let’s break it down simply.

High-risk drivers usually pay more for car insurance than people with a clean driving record. On average, they pay about $1,509 a year. That’s $428 more than safer drivers.

Now, why does this matter? If you’re labeled as high-risk, it means insurance companies think you’re more likely to have an accident or make a claim. That’s why they charge you more. But don’t worry, there are insurance companies out there that offer reasonable prices for high-risk drivers.

Take Dairyland, for example. They’re known for having good deals for drivers who’ve had a DUI. And if you’re a teenager who’s considered high-risk, Progressive might be your best bet because they often have the lowest prices for younger drivers in Washington.

Remember, though, it’s not all about the price. You want to be sure you’re getting the protection you need and that you’ll have good support if you ever need to make a claim. Farmers is another company you might want to look into. Their policies for high-risk drivers average about $1,258 a year, which could be a good deal for you.

To figure out the best option, use helpful tools like car insurance calculators. These can give you a personalized estimate based on your specific situation. They take into account things like your age, your car, and your driving history.

Exploring Insurance Options for Risky Drivers

If you’re someone who’s had a few bumps on the road and are considered a high-risk driver, finding the right car insurance can be a bit tricky, but it’s definitely doable. With a bit of knowledge and effort, you can find an insurance plan that works for you. Here’s how to go about it:

Firstly, it’s good to know that insurance companies might see you as high-risk if you’ve had accidents or violations. Being in this category often means you’ll pay more for car insurance. However, there’s a silver lining! If you stay out of trouble and keep your driving record clean for a while, insurance companies might give you better rates.

Next, there’s something called the Automobile Insurance Plan Service. This is a special program offered in many places for drivers like you who might’ve trouble getting insured. It’s worth checking out if you find yourself hitting a wall with traditional insurance options.

When you’re looking to get insured, it’s important to look at all your options. Compare plans that cover a lot of different situations (full coverage) with those that cover just the bare minimum required by law (minimum coverage). This way, you can decide which one fits your needs and your wallet the best.

Another tip is to consider taking a defensive driving course. Not only do these courses make you a safer driver, but they can also lead to discounts on your insurance rates with some companies.

Remember, choosing the right insurance provider isn’t just about the price. It’s also about feeling confident that they’ll support you, especially when you need help the most. So, take your time, do your research, and pick an insurance that offers a good balance of cost and customer service.

In the end, even if you’ve been labeled a high-risk driver, there are still plenty of ways to get good car insurance. Stay positive, keep working on your driving skills, and you’ll find a plan that has your back on the road.

Top-Rated High-Risk Driver Insurance Providers

If you’re a high-risk driver, finding car insurance that’s both affordable and reliable can be a bit tricky, but it’s not impossible. Some insurance companies specialize in offering policies to drivers who might’ve a few blemishes on their driving record. Let’s walk through some of your best options.

To start, Dairyland Insurance is known for its willingness to insure high-risk drivers. Expect to pay around $1,122 a year on average for a policy with them. This is a solid choice if you’re looking for a balance between cost and coverage.

Next up, we’ve National General. If you live in Washington and are considered a high-risk driver, Progressive is often recommended. They’re known for their customer service and have received high marks for their ability to cater to drivers like you.

For those who’ve had a DUI in Washington, you might want to check out Bristol West Insurance. They’re known for offering some of the most budget-friendly options for high-risk drivers with a DUI on their record.

Teenage drivers who are categorized as high-risk should consider The General. They’re recognized for providing affordable rates for young drivers who are still building their driving history.

When you’re getting quotes from these insurers, remember to be honest about your driving history, including any instances of reckless driving, traffic tickets, or DUIs. This way, you can get the most accurate quotes and find a policy that fits your needs.

Frequently Asked Questions

What Is the Best Auto Insurance for One At-Fault Accident?

The best auto insurance for one at-fault accident is State Farm, offering accident forgiveness and high customer satisfaction. Erie is also a good option with affordable premiums and low complaint index. Geico and USAA are recommended for low rates and coverage options.

What Do Insurance Companies Consider High Risk?

Insurance companies consider high-risk factors such as at-fault accidents, speeding tickets, DUI offenses, lapses in coverage, poor credit, and serious driving violations. These factors can lead to an increased risk profile and higher insurance rates for the driver.

Do High Risk Drivers Pay Lower Insurance Premiums?

High-risk drivers do not typically pay lower insurance premiums due to factors like DUI offenses, speeding tickets, and bad credit. Insurance rates are influenced by age, vehicle details, coverage level, and driving history, resulting in higher costs.

How Do I Get Around High Insurance?

To get around high insurance, consider taking defensive driving courses, improving your credit score, or bundling coverage with home or renters insurance. These strategies can help lower premiums and make insurance more affordable for high-risk drivers.

Conclusion

If you’re a high-risk driver looking for car insurance, you’re in luck. There are some great options out there that can give you the coverage you need at a price that won’t break the bank. Companies such as Dairyland, National General, Progressive, and The General are known for offering good deals. Specifically, Dairyland and National General get top marks for making their customers happy and providing a variety of coverage choices.

It’s really important to shop around. Make sure to compare different quotes. You’ll want to take a close look at your driving record, how old you are, and your credit score. These things can affect how much you’ll pay for car insurance. By considering all these factors, you’ll be able to find the right insurance plan that’s tailored just for you, even if your driving past has a few bumps.